Calculate hourly rate for semi monthly payroll

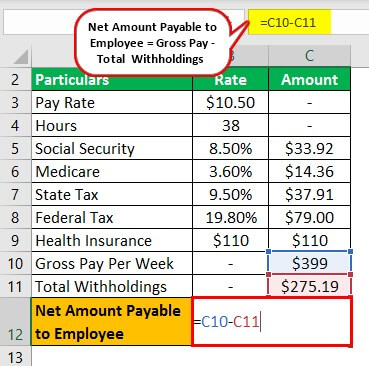

Such as to calculate exact taxes payroll or other financial. Firstly you need to know the annual salary of the employee.

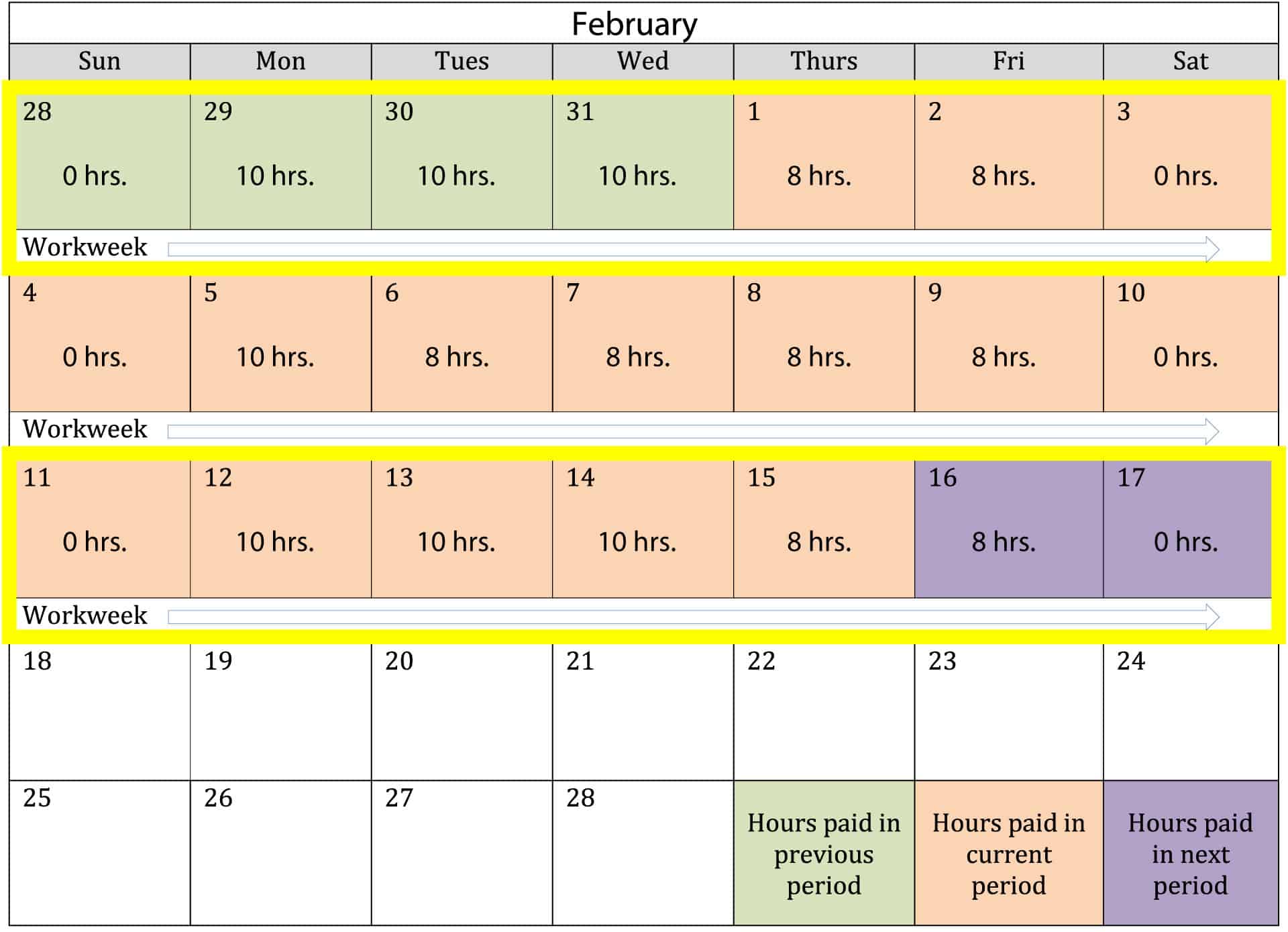

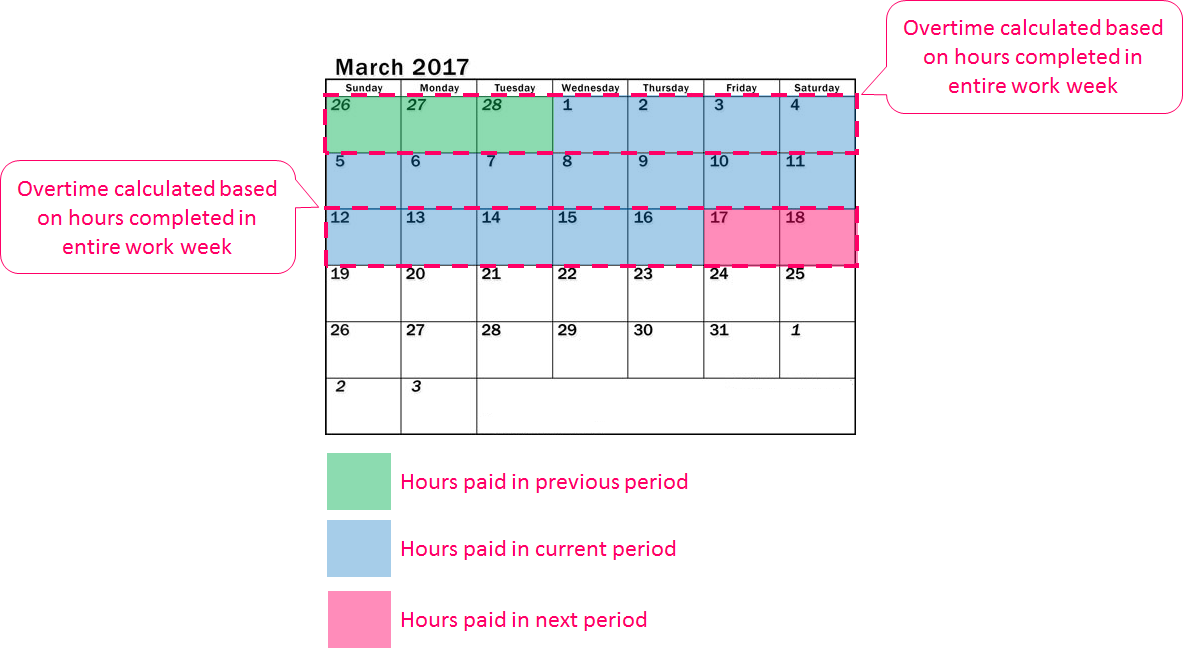

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Access to our award-winning US-based customer service team.

. Your pay frequency may differ such as if youre paid bi-weekly semi-monthly or monthly. 70 hours x 10 700 your gross semi. And if employees are paid once a month there are.

Your full-time salaried employee Linda makes 56000 annually. For example if your receptionist worked 40 hours. Now we already know that a semi-monthly payment regime has 24 pay periods.

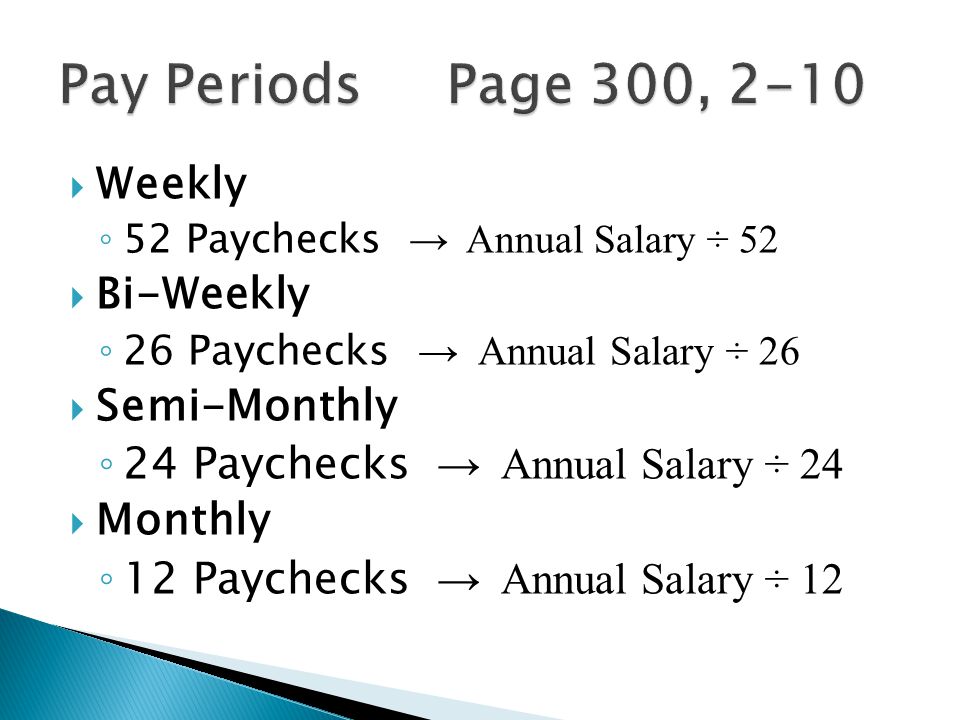

Tax rates are dependent on income brackets. For example if you earn 2000week your annual income is calculated by taking 2000 x 52 weeks for a total salary of 104000. If employees are paid semi-monthly there are 24 pay periods.

Multiply hours worked by your hourly rate. Over six million small businesses in the US. 290 for incomes below the threshold amounts shown in the table.

It typically takes 2 minutes or less to run payroll. 20 x 225hour 15 x 15 450. You pay her semi-monthly 24 pay periods in a year.

Pay his regular rate from above then determine overtime. Switch to Georgia salary calculator. For hourly employees gross pay is the number of hours worked during the pay period multiplied by the hourly rate.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Florida. Are in the same boat as you. This Georgia hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Wages deductions and payroll taxes completed automatically. Federal Payroll Tax Payment Frequency. Medicare tax rate is 145 total including employer contribution.

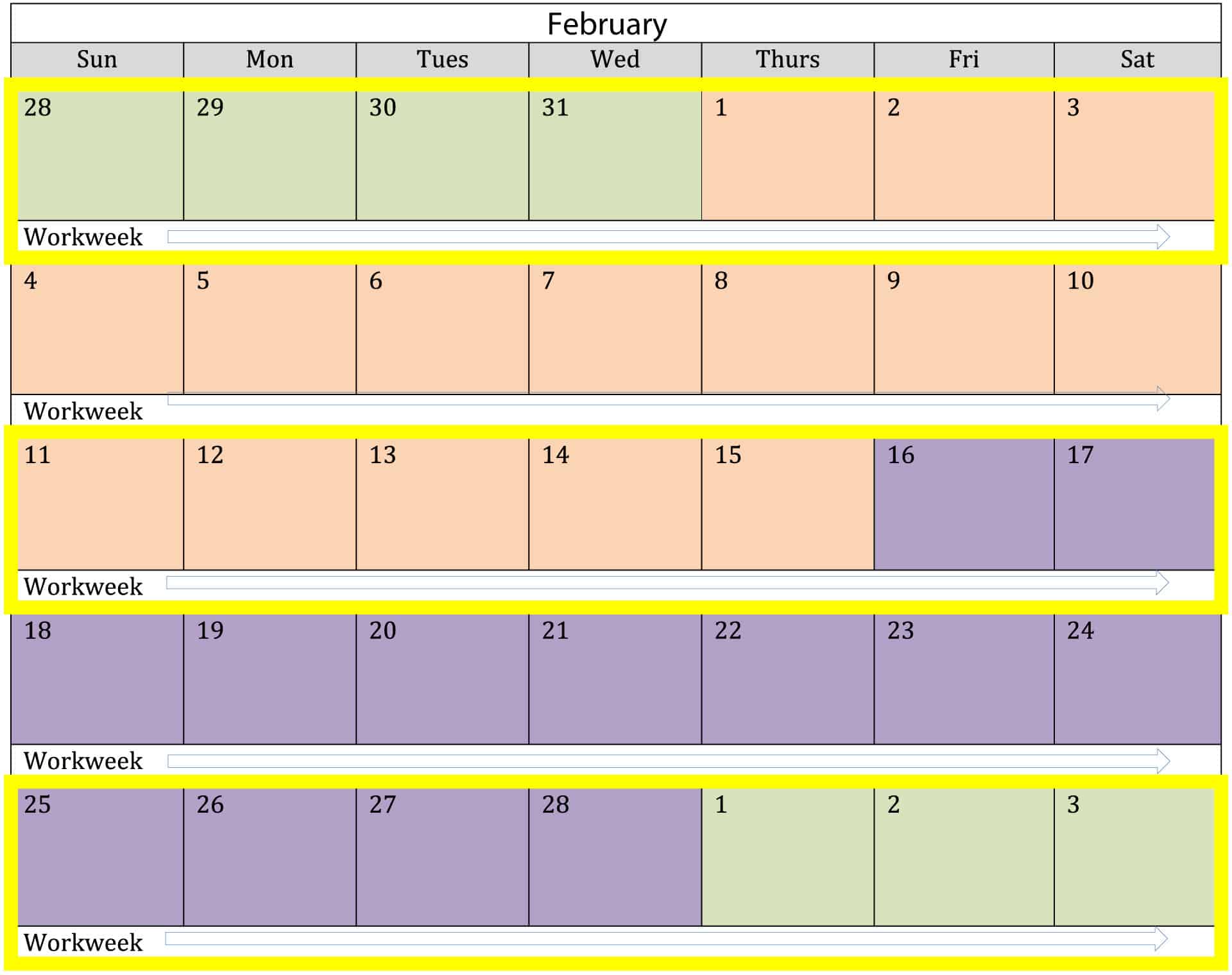

How to Calculate Overtime on a Semi-Monthly Pay Period. Utah is one of eight states in the United States that have a flat rate personal income tax. There are 26 pay periods.

This is also gross pay albeit overtime. If youre a small business owner trying to figure out how to calculate payroll youre not alone. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

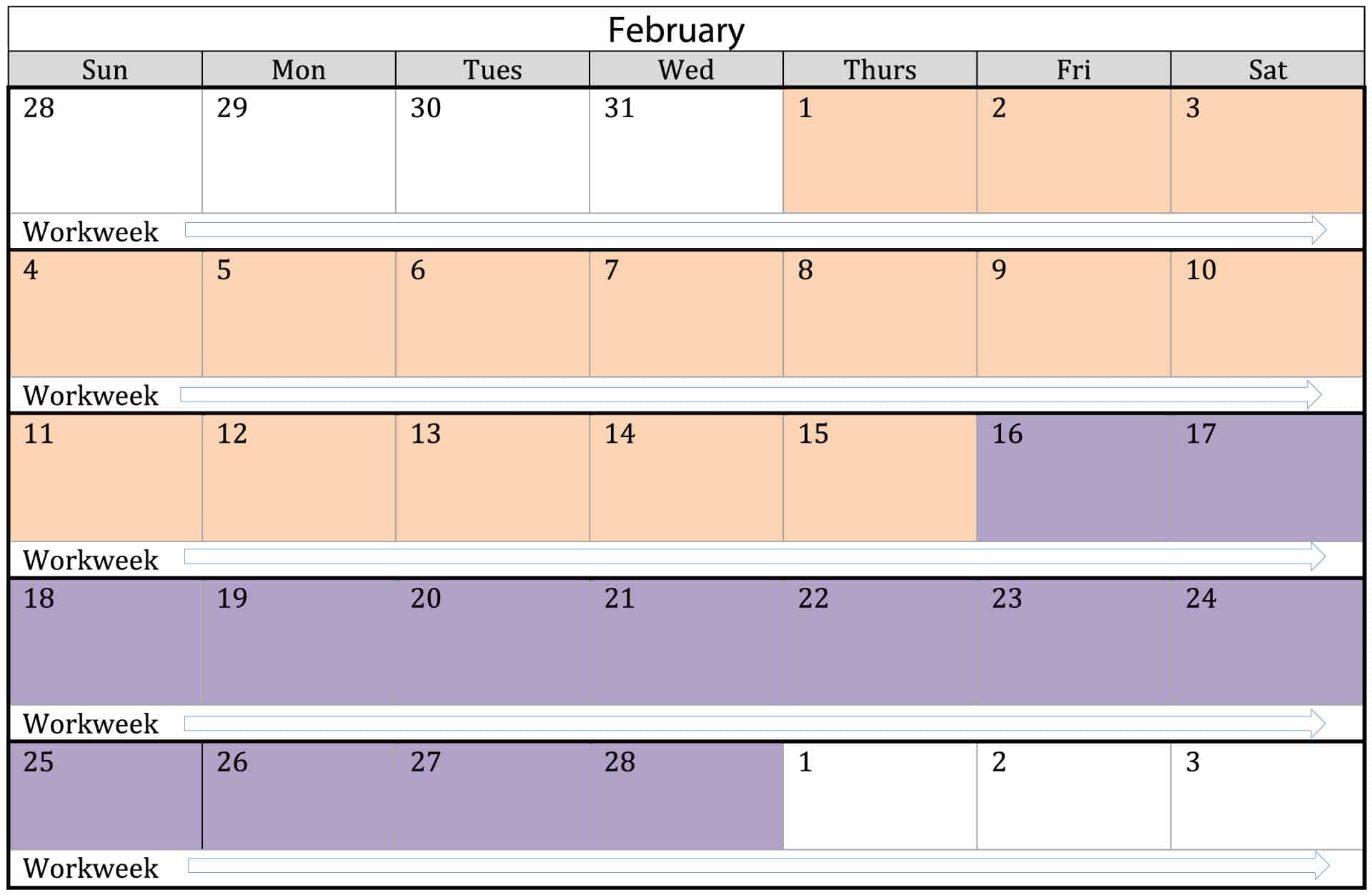

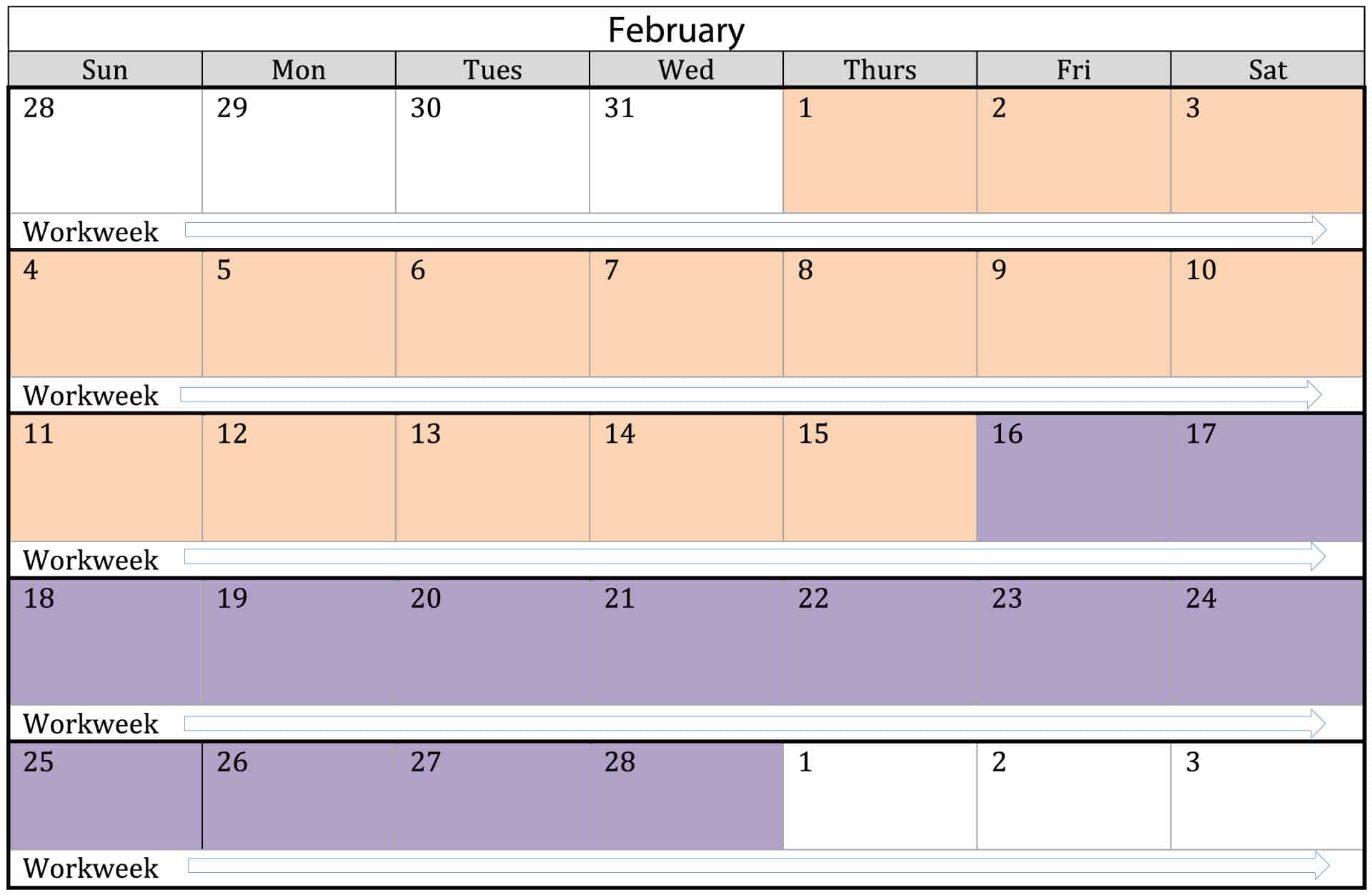

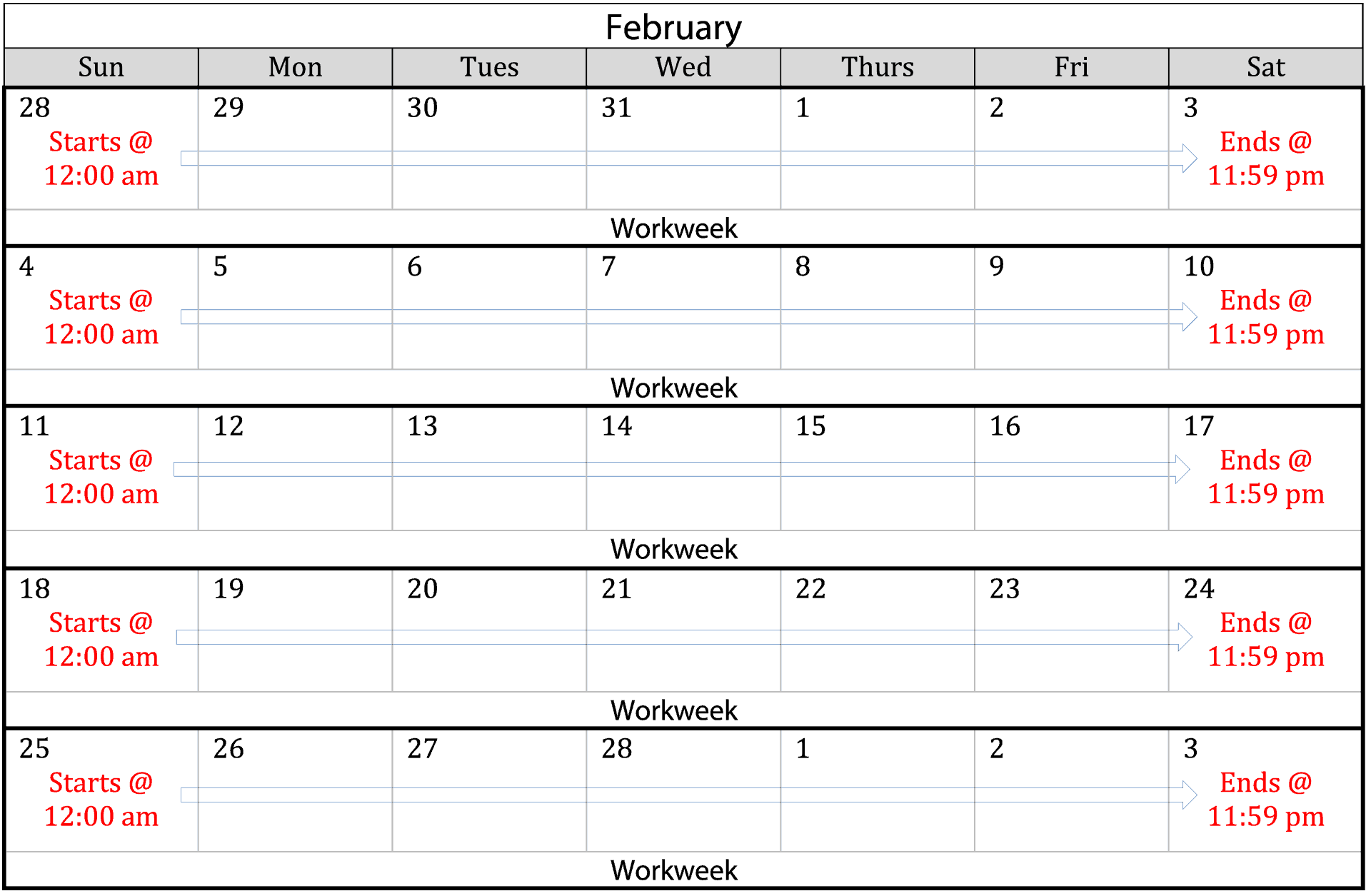

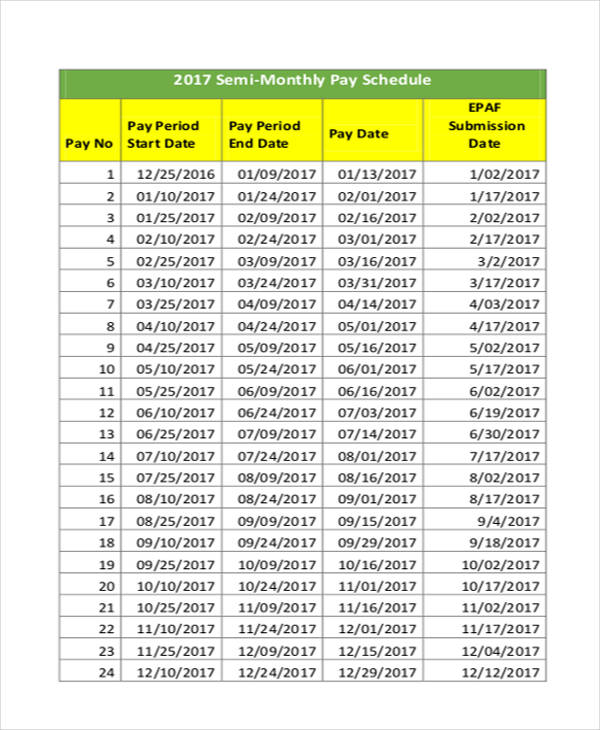

Let us assume that an employee earns a gross of 100000 annually. In the case of payroll periods semi-monthly usually means twice a month with one pay period starting the 1st day of the month and ending on the 15th day of the month and the other pay period starting on the 16th of the month and ending on the last day of the month. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

You calculate gross wages differently for salaried and hourly employees. Incomes above the threshold amounts will result in an additional 045 total including employer contribution. The Florida Reemployment Tax minimum rate for 20221 is 0129 and can be.

An hourly semi-monthly employees pay may fluctuate each pay period but a salaried employees tends to stay the same. The semi-monthly salary of a salaried employee can be calculated in a very simple manner. For instance if you worked 70 regular hours during the semi-monthly pay period and earned 10 per hour you would calculate as follows.

Its a challenge to manage employees calculate their hourly paychecks and process your payroll all while running a small business. 09 on top of the regular Medicare tax rate. Utah has a flat personal income tax rate of 495.

Calculating the Semi monthly pay of a salaried employee. 10 x 2 20 hours. Why Gusto Payroll and more.

To calculate an hourly employees gross wages for a pay period multiply their hourly pay rate by their number of hours worked.

Difference Between Bi Weekly And Semi Monthly Difference Between

What Is A Pay Period How Are Pay Periods Determined Ontheclock

Elaws Flsa Overtime Calculator Advisor

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

Salaries Ppt Video Online Download

![]()

Download Free Bi Weekly Timesheet Template Replicon

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

Payroll Formula Step By Step Calculation With Examples

4 Ways To Calculate Annual Salary Wikihow

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule

How To Calculate Pay Using The State Formula Rate Mit Human Resources

What Is A Pay Period Free 2022 Pay Period Calendars

Semi Monthly Pay Period Timesheet Mobile

Hourly Wage To Biweekly Paycheck Converter Hourly Salary Conversion Calculator

9 Payroll Schedule Templates Word Docs Free Premium Templates

The Pros And Cons Biweekly Vs Semimonthly Payroll

The Art Of Calculating Overtime On A Semi Monthly Pay Schedule